Shell company

A shell company or corporation is one that does not run any significant active business operation or hold assets, they are a front for a company in a certain location. They are not in themselves illegal and are commonly set-up in locations to benefit from tax, employment or other laws in a certain jurisdiction, one that is not the same as their location of their primary active business. This mechanism is sometimes referred to as offshoring because these companies are registered offshore from the main activity of the business, or as ringfencing because it helps protect an entity from certain risks most often legal tax risks or the avoidance of them but sometimes also money laundering.

Shell companies are similar in their nature to special purpose vehicles (SPV) for building development in that they act as a second entity that allows risk to be drawn away from the main company or funder, for instance in the case of a large development. They differ from SPVs because they generally do not hold any assets and are merely an empty 'shell' of a company used to reduce financial risk for the parent company. SPVs often serve the same purpose as a shell company in terms of risk allocation but are more likely to have assets associated with them, for example a new development, land or a project associated risks.

See also article Special purpose vehicles SPV for building development

In the UK HM Revenue & Customs Company Taxation Manual CTM06610 (Change of Ownership: Shell Companies) refers to shell companies as being companies which:

- 'is not carrying on a trade'

- 'is not a company with an investment business; and'

- 'is not carrying on a UK property business.'

In broad terms the rules associated with this prevent certain reliefs for non-trading debits and losses (CTM06620) where there is a Shell Company which undergoes a change of ownership as defined under CTA10/S719 (CTM06340). Where the rules apply, they treat the actual accounting period in which the change of ownership took place as two separate notional accounting periods, the first ending with the date of change and the second consisting of the remainder of the period. The non-trading amounts for the actual period are then apportioned between the two notional periods.

[edit] Related articles on Designing Buildings

- Business model.

- Company acquisitions in construction.

- Consortium.

- Construction loan.

- Construction organisation design.

- Construction organisations and strategy.

- Joint venture.

- Leaseback.

- Midland Expressway Ltd v Carillion Construction Ltd & Others.

- Partnering and joint ventures.

- Partnership.

- Ringfencing.

- Special purpose vehicles.

- Types of construction organisations.

Featured articles and news

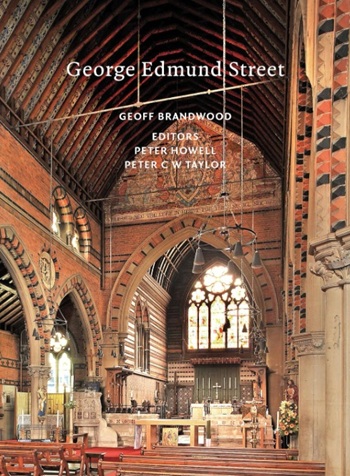

One of the most impressive Victorian architects. Book review.

Common Assessment Standard now with building safety

New CAS update now includes building safety questions as mandatory.

RTPI leader to become new CIOB Chief Executive Officer

Dr Victoria Hills MRTPI, FICE to take over after Caroline Gumble’s departure.

Social and affordable housing, a long term plan for delivery

The “Delivering a Decade of Renewal for Social and Affordable Housing” strategy sets out future path.

A change to adoptive architecture

Effects of global weather warming on architectural detailing, material choice and human interaction.

The proposed publicly owned and backed subsidiary of Homes England, to facilitate new homes.

How big is the problem and what can we do to mitigate the effects?

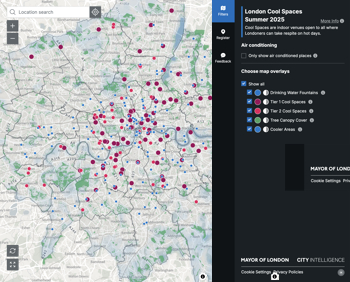

Overheating guidance and tools for building designers

A number of cool guides to help with the heat.

The UK's Modern Industrial Strategy: A 10 year plan

Previous consultation criticism, current key elements and general support with some persisting reservations.

Building Safety Regulator reforms

New roles, new staff and a new fast track service pave the way for a single construction regulator.

Architectural Technologist CPDs and Communications

CIAT CPD… and how you can do it!

Cooling centres and cool spaces

Managing extreme heat in cities by directing the public to places for heat stress relief and water sources.

Winter gardens: A brief history and warm variations

Extending the season with glass in different forms and terms.

Restoring Great Yarmouth's Winter Gardens

Transforming one of the least sustainable constructions imaginable.

Construction Skills Mission Board launch sector drive

Newly formed government and industry collaboration set strategy for recruiting an additional 100,000 construction workers a year.

New Architects Code comes into effect in September 2025

ARB Architects Code of Conduct and Practice available with ongoing consultation regarding guidance.

Welsh Skills Body (Medr) launches ambitious plan

The new skills body brings together funding and regulation of tertiary education and research for the devolved nation.

Paul Gandy FCIOB announced as next CIOB President

Former Tilbury Douglas CEO takes helm.